UK-India trade deal

The United Kingdom and India signed a major free trade agreement, the Comprehensive Economic and Trade Agreement (CETA), on 24 July 2025, aiming to significantly boost bilateral trade by reducing tariffs and increasing market access for goods and services. The agreement is expected to benefit both economies, potentially adding £25.5 billion in trade annually by 2040 and contributing approximately £4.8 billion per year to the UK economy. T

The United Kingdom and India signed a major free trade agreement, the Comprehensive Economic and Trade Agreement (CETA), on 24 July 2025, aiming to significantly boost bilateral trade by reducing tariffs and increasing market access for goods and services. The agreement is expected to benefit both economies, potentially adding £25.5 billion in trade annually by 2040 and contributing approximately £4.8 billion per year to the UK economy. T

Key Features of the UK–India Trade Deal:

Tariff Reductions:

India will eliminate tariffs on 99% of UK exports, particularly for products such as whisky (reducing from 150% to 40% over a decade), gin, cars (from over 100% to 10%), beauty products, chocolates, medical devices, and machinery.

The UK will give duty-free access to 99% of Indian exports, including textiles, leather, jewelry, food items, and footwear.

Market Access:

British companies will have greater access to bid for service contracts in India.

Sectors expected to benefit include UK automobile and spirits manufacturers, and Indian textile, gems, jewelry, and engineering exporters.

Timing and Ratification:

The deal was formally signed in July 2025 but is subject to ratification by both countries’ parliaments, so full implementation may take up to a year.

Negotiations for the agreement lasted over three years, starting in January 2022.

Economic Significance:

Total bilateral trade between the two nations was about £42–56 billion last year, with an ambition to double it by 2030.

The UK government projects further increase in trade, employment, and investment as a result of the agreement.

Impact of the UK–India Trade Agreement on Local Businesses: –

Export Growth Opportunities:

UK exporters—especially in automobiles, spirits (whisky, gin), chocolates, medical devices, and machinery—will benefit significantly as India eliminates or reduces tariffs. This will make their products more competitive in one of the world’s largest and fastest-growing markets.

Cost Reduction and Market Access:

Lower tariffs mean reduced costs for businesses exporting to India, improving margins and allowing for price competitiveness. British companies will also gain better access to India’s government procurement and services sector.

SME Benefits:

Small and medium-sized UK enterprises (SMEs) in agriculture, engineering, and food production gain new export opportunities, as previous tariff barriers made entry difficult or economically unviable.

For Indian Local Businesses Export Advantages:

Indian firms in textiles, leather, jewelry, food products, footwear, and engineering goods will get duty-free access to the UK market. This will especially help traditional and labor-intensive sectors, boosting exports and job creation.

Competition and Modernization:

Indian companies importing UK machinery, technology, and components will benefit from lower input costs, raising productivity and quality. However, some local manufacturers may face increased competition from UK imports, especially in consumer goods.

For Both Sides

Value Addition:

Local businesses poised to become part of transnational supply chains—especially in manufacturing and services—will gain from the broader partnership and trade liberalization.

Potential Challenges:

Some sectors exposed to greater competition (e.g., Indian automotive or processed foods) could face pressure unless domestic industries modernize or specialize further.

Gradual Change:

Many changes (tariff reductions, expanded procurement, etc.) phase in over several years, providing local businesses on both sides time to adapt to the new competitive environment.

Key Industries Affected by the UK–India Trade Agreement: –

The UK–India trade agreement has a sweeping impact across a wide array of industries, with significant implications for both countries’ major export and manufacturing sectors. The most affected industries include:

Automotive

Tariff Impact: UK car exports to India see tariffs drop from over 100% to 10% (under a quota system), though these reductions are phased and subject to quotas for luxury and premium segments.

Beneficiaries: British brands like Jaguar Land Rover, Rolls-Royce, Aston Martin, and other luxury brands gain greater market access in India. Indian automobile and auto-component makers gain duty-free and reduced-tariff access to the UK.

Spirits and Alcoholic Beverages

Tariff Impact: Indian tariffs on UK whisky and gin reduce from 150% to 75% initially, with further cuts to 40% over ten years — greatly benefiting Scotland’s iconic Scotch whisky and British gin exports.

Beneficiaries: Premium brands and Indian consumers, although the consumer impact may be moderated by state-level taxes in India.

Textiles and Apparel

Tariff Impact: The UK removes up to 12% import duties on Indian textiles and garments, granting Indian manufacturers a competitive edge over non-FTA countries.

Beneficiaries: Indian textile and garment exporters (including SMEs and large established firms), British retailers benefiting from lower import costs, and UK apparel and fashion industries gaining cheaper access to Indian textiles.

Processed Foods, Agriculture, and Marine Products

Tariff Impact: UK eliminates duties (up to 20% or higher) on marine products, processed foods, and a vast range of Agri-products (spices, tea, coffee, pickles, seafood), unlocking new markets for Indian food processors.

Beneficiaries: Indian seafood, dairy, and packaged foods exporters; UK consumers will have access to a wider range of affordable products.

Chemicals, Pharmaceuticals, and Medical Devices

Tariff Impact: Reduction or elimination of UK tariffs on Indian pharmaceuticals, medical devices, and chemicals; India lowers tariffs on certain British machinery, chemical products, and cosmetics.

Beneficiaries: Manufacturers and exporters from both countries, with potential to enhance collaboration in the life sciences and tech industries.

Footwear, Leather, Gems, and Jewelry

Tariff Impact: The UK grants duty-free access to 99% of Indian footwear, leather goods, and jewelry exports.

Beneficiaries: Indian SMEs and exporters in traditional and job-creating sectors, as well as UK importers and retailers.

Aerospace, Machinery, and Equipment

Tariff Impact: UK aerospace and machinery exports face tariff reductions from up to 11% (aerospace) and 22% (electrical machinery) down to zero or significantly lower.

Beneficiaries: UK industrial suppliers, British giants like Rolls-Royce and Airbus, Indian purchasers and manufacturers benefiting from cheaper capital goods.

Conclusion:

The UK–India agreement especially boosts automotive, spirits, textiles, food, chemicals, aerospace, and traditional export industries (leather, gems, and footwear), opening new channels for growth, investment, and partnership on both sides, while driving modernization and price competitiveness across the board.

Digital Services, Professional Mobility, and Public Procurement

Non-Tariff Impact: Easier mobility and mutual recognition for professionals; UK firms access Indian public tenders; expanded digital and financial services cooperation.

Beneficiaries: UK and Indian technology, consulting, and financial service providers; Indian professionals filling UK skill gaps.

Changes in UK Food Exports after India and UK trade deal (2025)

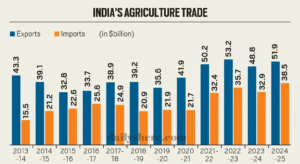

Overall Export Trends

The total value of UK food, feed, and drink exports was £24.6 billion in 2024, a 0.5% rise from 2023, but overall export volumes remain about 20% below pre-pandemic levels.

In Q1 2025, UK food and drink exports showed stabilization and a slight upturn, especially toward non-EU markets, with growth of over 10% to places like Ireland, Malaysia, and the UAE.

Impact of the UK-India Trade Agreement

The new UK-India FTA is set to boost UK food and drink exports by cutting Indian tariffs on products like whisky, gin, salmon, biscuits, lamb, chocolate, and processed foods. Many tariffs on these exports will reduce from as high as 150% (for whisky) to 40% over ten years, with most others seeing major reductions immediately.

Indian market access for British lamb, chocolate, biscuits, salmon, and spirits has expanded. However, the agreement does not improve market access for UK dairy products, apples, or oats in India—these sectors were excluded from concessions.

Developments in EU Trade

Post-Brexit, UK food exports to the EU had dropped substantially. In 2025, a UK-EU Sanitary and Phytosanitary (SPS) agreement will reduce bureaucracy, eliminate export health and plant health certificates, and remove routine border checks on agri-food products. This results in easier, faster trade and a resumption of previously banned exports like fresh sausages and certain shellfish to the EU.

British food products, especially fresh and chilled items, are recovering lost EU market share as regulatory friction eases and supply chains stabilize.

Sector Details

Export growth is most significant in premium processed foods, spirits, and select meats (like lamb and salmon), as tariff barriers are dismantled in India and logistics improve with the EU.

Traditional UK food exports—such as whisky, gin, chocolate, biscuits, and processed meat—are the biggest winners from recent trade deals. British cheese, butter, apples, and oats face continued challenges in export growth to India, as these items remain outside FTA tariff concessions.

Regulatory and Standards Assurance

The UK government has maintained domestic food standards in all recent deals, meaning imports and exports must still meet regulatory requirements and food safety standards. The new SPS agreement may require the UK to maintain alignment with some EU standards, leading to streamlined trade but with limited autonomy over regulatory changes.

Effects of the India-UK Trade Agreement on Agriculture

- Huge Expansion of Indian Agricultural Exports. More than 95% of Indian agricultural products now have zero tariffs in the UK market, giving Indian exporters access to one of the world’s top and high-value food retail markets. Exports to benefit most: Fruits and vegetables (grapes, onions, mixed vegetables, preserved vegetables, jackfruit, millets) Spices (turmeric, pepper, cardamom) and spice mixes Coffee and tea (including Indian instant coffee, which will get a competitive edge) Processed foods (mango pulp, pickles, ready-to-eat meals) Bakery items (bread, cakes, pastries) Marine products (shrimp, tuna, fishmeal, seafood) will see major growth, especially for coastal India exporters.

- Growth Expected Agricultural exports from India to the UK will grow by more than 20% in the next three years, with the government’s target of reaching $100 billion in agricultural exports by 2030 getting a big push from this agreement.

- Safeguards for Sensitive Sectors Exclusions on Sensitive Products: India has protected certain sensitive products: No concessions on dairy (milk, cheese, butter, ghee), apples, oats, or edible oils. Major staple grains (wheat, rice, maize, millets) are also out of tariff cuts, so domestic farmers dependent on these crops are protected. Selective access for some niche UK products (cranberries, durians, certain mushrooms) with negligible production in India, to avoid impact on local producers.

- Price and Market Indian farmers can now get premium prices for their products, with the UK market providing parity with European exporters who had freer access earlier. Duty elimination means Indian Agri-products are now more competitive, helping them to expand not only in ethnic but also mainstream British retail and food processing sectors.

- Support for Diversification and Rural Economy The agreement supports a shift towards high-value agricultural products, export diversification (jackfruit, pulses, organic herbs), and stabilising domestic prices through better export outlets. Big opportunities for smallholder and rural farmers, especially in fisheries and processed foods, which are labor-intensive and critical for rural economies.

- Regulatory Cooperation The deal also simplifies sanitary and phytosanitary (SPS) regulations, so exporters can navigate paperwork and compliance more easily and shipments to the UK can be faster and more reliable. Conclusion: India-UK trade agreement is a big win for Indian agriculture, giving more export opportunities, higher incomes, and new market access for farm, processed, and seafood products—while protecting India’s most sensitive food sectors. For British agriculture, the impact is limited, but some products get better access.

Leave a Reply